At TokenTax, we build first content to coach and empower the various copyright investors we serve. Our informational article content replicate the latest tax suggestions from companies throughout the world and are frequently updated for being accurate, actionable, and present.

“As copyright tax legislation develops, I believe we’ll see some retracing of earlier regulatory oversteps,” Wride mentioned.

When you subsequently get rid of your copyright benefits, you’ll incur a cash get or decline based upon how the price of your staking benefits improved because you initially gained it.

You must acknowledge money at The purpose you'll be able to transfer, provide, or otherwise make use of the coins (frequently called “dominion and Handle”). In the event the tokens are locked or limited, you could delay reporting till All those constraints are lifted.

In this article’s simply how much tax You will be having to pay on the money from Bitcoin, Ethereum, together with other cryptocurrencies.

Disclaimer: The information delivered in this site publish is for standard information applications only. The information was accomplished to the top of our knowledge and would not assert both correctness or accuracy.

Once you provide your staking rewards, you’ll pay funds gains tax based on how the price of your copyright modified because you at first been given it.

While the blockchain is under-going an enhance, your Ethereum cash will carry on to hold a similar rights and tasks as before.

Tax Loss Harvesting: You can even use a method known as tax loss harvesting, in which you provide other copyright assets in a decline to offset the gains from a staking rewards.

Airdrops and tough forks: If you receive new tokens from an airdrop or a hard fork, the IRS considers them profits as you Ethereum Staking And Taxes: What Investors Need To Know In 2025 can entry them and taxes them accordingly.

“You might have to report transactions with electronic assets which include copyright and non fungible tokens (NFTs) in your tax return,” the IRS reported within a put up. “Revenue from electronic assets is taxable.”

copyright delivers the opportunity to wrap staked ETH for cbETH — a liquid copyright that could be traded even before the Shapella improve.

Intense solution: The aggressive tactic is to take care of wrapping ETH for cbETH to be a non-taxable party.

In summary, both of those the receipt and sale of staking benefits feature distinctive tax implications. Knowing and adhering to those pointers is key to being compliant with IRS guidelines and successfully controlling your copyright taxation duties.

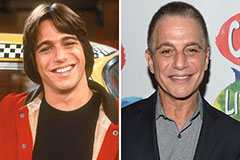

Tony Danza Then & Now!

Tony Danza Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!